Welcome to Bodhayan

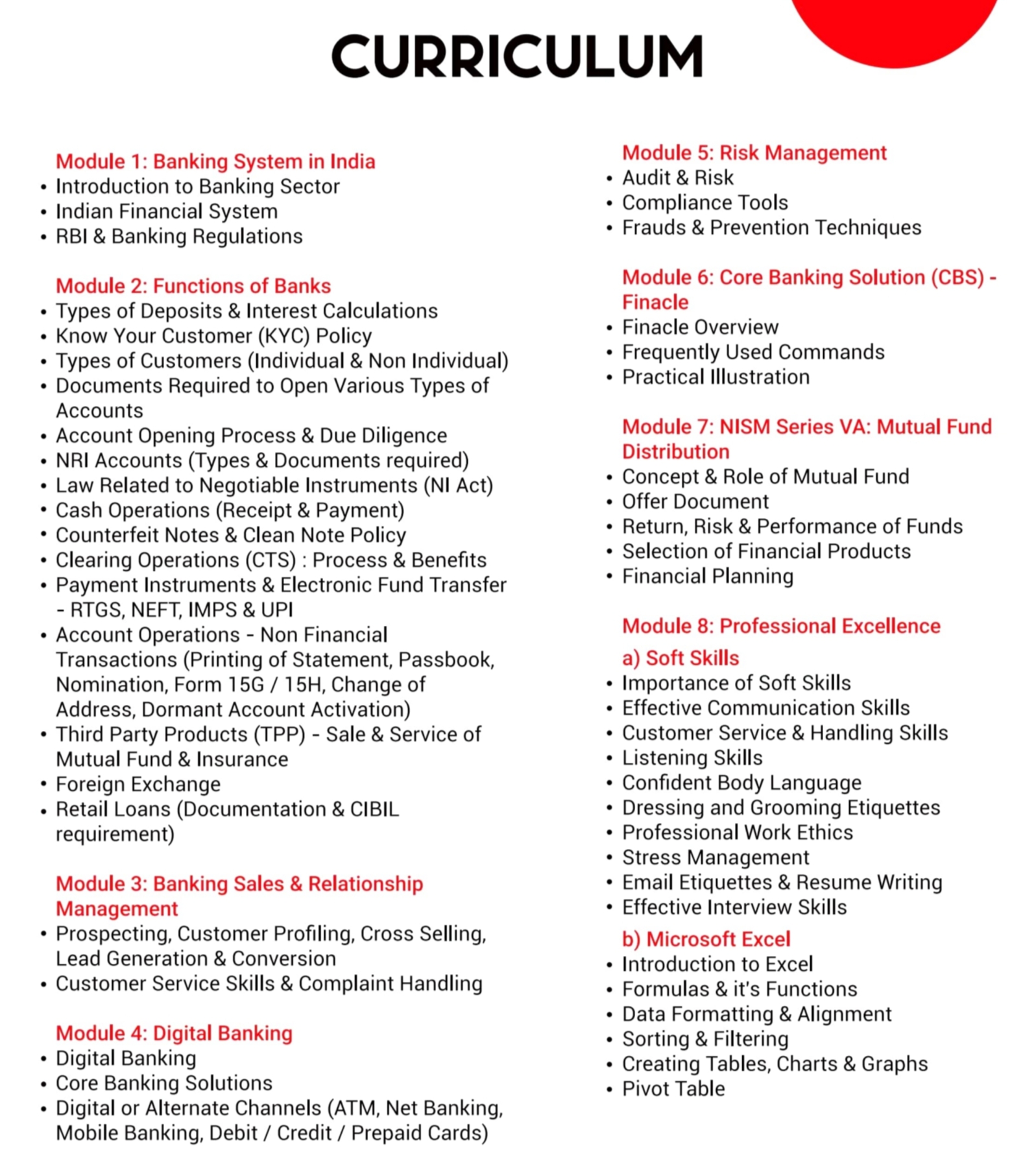

Curriculum: Post Graduate Diploma in Banking (PGDB)

Module 1: Banking System in India

- Introduction to Banking Sector

- Indian Financial System

- RBI & Banking Regulations

Module 2: Functions of Banks

- Types of Deposits & Interest Calculations

- Know Your Customer (KYC) Policy

- Cash Operations & Clearing Operations

- Payment Instruments & Electronic Fund Transfer

- Foreign Exchange

- Retail Loans (Documentation & CIBIL requirement)

Module 3: Banking Sales & Relationship Management

- Prospecting, Customer Profiling, Cross Selling

- Customer Service Skills & Complaint Handling

Module 4: Digital Banking

- Digital Banking & Core Banking Solutions

- Digital or Alternate Channels (ATM, Net Banking, Mobile Banking, Debit/Credit/Prepaid Cards)

Module 5: Risk Management

- Audit & Risk

- Compliance Tools

- Frauds & Prevention Techniques

Module 6: Core Banking Solution (CBS) - Finacle

- Finacle Overview & Practical Illustration

Module 7: NISM Series VA: Mutual Fund Distribution

- Concept & Role of Mutual Fund

- Offer Document

- Return, Risk & Performance of Funds

- Selection of Financial Products

- Financial Planning

Module 8: Professional Excellence

- Soft Skills (Communication, Customer Service, Listening, etc.)

- Microsoft Excel (Introduction, Formulas, Formatting, Tables, Pivot Tables)

Coaching supports teachers to improve their capacity to reflect and apply their learning to their work with students and also in their work with each other.

Praveen Dhenwal Joined Kotak Mahindra Bank as Assistant Manager

Vikash Sidha Joined Kotak Mahindra Bank as Assistant Manager

Mr Abhimanyu Singh Joined Kotak Mahindra Bank as Deputy Manager